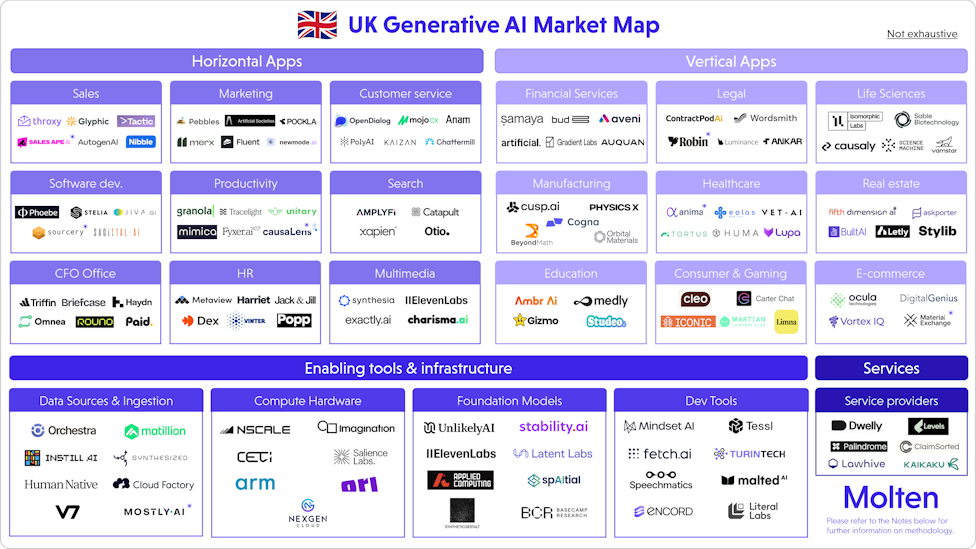

Molten is excited to reveal its 2025 UK Generative AI Market Map. With 250+ active companies, the UK Gen AI ecosystem is thriving, with some local champions emerging across both the application (Synthesia, Cleo, Granola) and infrastructure (ElevenLabs, V7) layers.

We’ve included a few key insights from our research below as an overlay to the market map. Please see notes at the end of this article for further information on methodology.

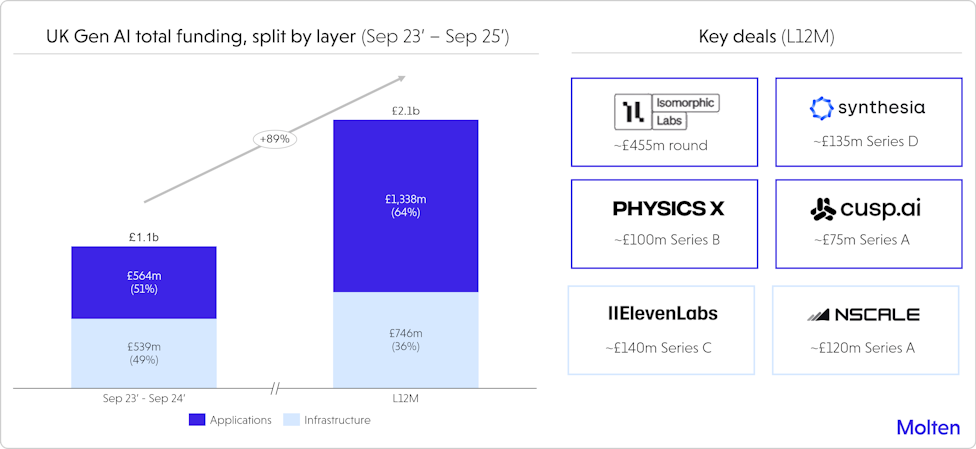

#1: UK Gen AI funding has soared over the last year, driven by high-value deals increasingly pivoting from infrastructure to the application layer

UK Gen AI funding continues to increase significantly, reaching ~£2b in the L12m (>85% YoY growth). This is largely driven by a small number of larger transactions, primarily in the application layer, with four rounds (Isomorphic Labs, Synthesia, PhysicsX, and Cusp AI) accounting for over a third of total L12M Gen AI funding with Isomorphic making up almost 60% of this total.

These large rounds in the application layer mean that total funding is more skewed towards applications than infrastructure, in contrast to previous years where the split was more balanced.

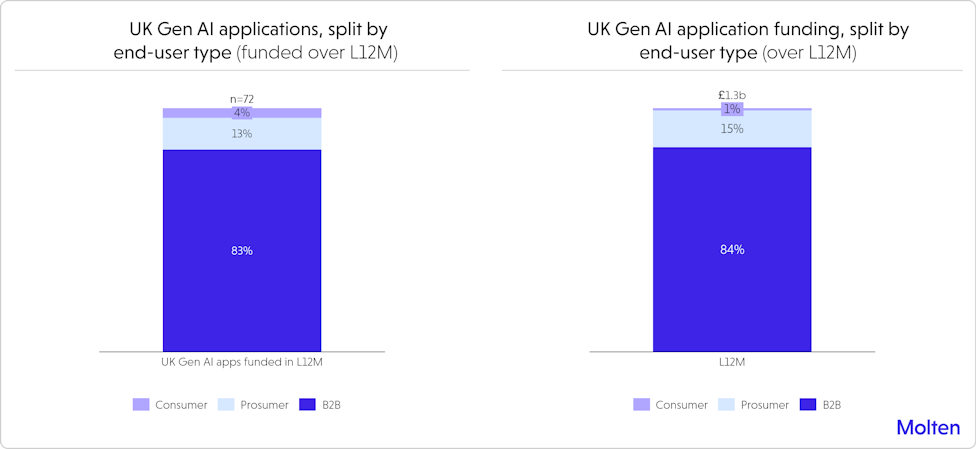

#2: B2B-focused applications account for a significant majority of UK Gen AI application business volumes and L12M funding

~80% of all UK Gen AI applications are B2B-focused. From a funding perspective, B2B applications also make up ~85% of funding in the application layer over the L12M. Prosumer/consumer applications are largely concentrated in the productivity segment (Tracelight, Granola), with newly minted unicorn Cleo positioning itself as an outlier in the personal finance space.

The slower emergence of consumer-facing Gen AI applications in the UK points to a market structure fundamentally different from the B2B model. While businesses are building a portfolio of specialised agents across different functions, the consumer space is being captured by a handful of dominant general-purpose US platforms like ChatGPT and Perplexity. This creates high barriers to entry for alternative consumer-focused solutions and suggests consumer AI will be a contest between a few all-encompassing platforms.

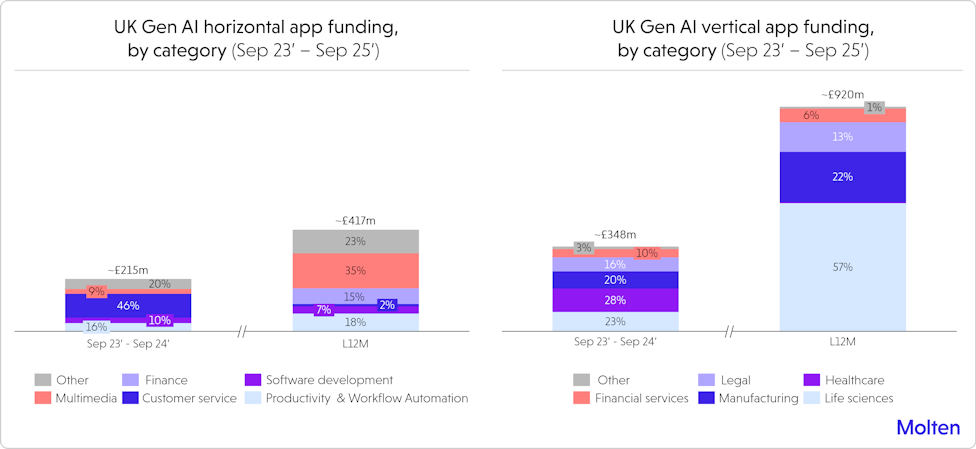

#3 – Most of UK Gen AI application funding over L12M is concentrated in multimedia & productivity for horizontal apps and life sciences & manufacturing for vertical apps

Gen AI application funding is highly concentrated across both the horizontal and vertical application landscape, with the top 5 sub-categories accounting for >80% of total funding over the L12M. Multimedia and Productivity lead the way on the horizontal front (driven by Synthesia’s ~£135m Series D and Granola’s ~£30m Series B ) while life sciences and manufacturing account for >75% of total vertical app L12M funding (driven by Isomorphic Labs ~£450m round and Cusp AI’s ~£75m Series A).

#4 – We are seeing a wave of AI-enabled service providers / AI-rollups at the pre-seed and Seed stage, mirroring developments in the US market

Our Gen AI Map introduces a “Service” layer on top of the traditional application and infrastructure layers. This classification has been made necessary by the recent surge of businesses that are fundamentally redefining service delivery through the speed and efficiency of AI-powered workflows. Examples of new service players coming to market over the last 12-18 months include Palindrome (wealth management), Claimsorted (insurance), and Dwelly (real estate).

The service layer still accounts for a very minor share of total Gen AI funding. This is not surprising, given the AI-enabled services model has had the strongest early momentum in the US. That said, we expect the value contribution of services to grow in the next two-three years, as UK businesses graduate from pre-Seed/Seed rounds to raise more advanced rounds.

#5 – M&A markets are heating up, with foundational model providers actively looking to move up the stack

The UK Gen AI market has seen strong M&A momentum over the last three quarters, with interesting activity from US foundational models looking to move up the stack. Open AI’s acquisition of Context.ai and Anthropic’s purchase of HumanLoop represent a clear strategic imperative, with model providers increasingly looking to own the middle-layer between raw AI models and real-world applications.

We expect continued M&A activity in the UK Gen AI ecosystem over the next year, with key drivers including (i) growth-stage Gen AI businesses turning to inorganic growth to consolidate their market position; (ii) Big Tech and legacy software providers prioritising acqui-hires over developing products in-house from scratch; and (iii) foundational model providers continuing to move up the stack.

What’s Next?

Thank you for reading this piece, we hope you found the market map and insights valuable.

The UK Gen AI landscape is ripe with opportunity — we can’t wait to share our updated map and insights next year. In the meantime, if you are building a Gen AI company in the UK, we would love to talk with you.

This market map has been prepared by Molten Ventures plc for general information purposes only to showcase the UK Generative AI ecosystem, encompassing applications, services, and enabling tools and infrastructure, with a core emphasis on the application layer. It covers both UK-headquartered companies as well as companies that were founded in the UK and/or with a continued strong UK presence. The map is not intended to be exhaustive, only “Gen-AI native” applications have been included excluding traditional SaaS tools whose Gen-AI capabilities are not core. Molten’s analysis is based on funding data from Crunchbase (as at 15 September 2025), which served as the foundation with market segmentation developed through custom tagging and manual enrichment. Figures in the supporting analysis may differ from other market studies due to differences in methodology. Asterisks indicate current Molten portfolio companies, otherwise no association or endorsement is implied with any company named, all trademarks and logos remaining the property of their respective owners. Inclusion or omission of any entity does not constitute advice or recommendation and should not be relied upon for any investment decisions. No representation or warranty is given as to the accuracy, completeness, or fitness for purpose of this information, and no liability is accepted for any loss arising from its use.